The double-entry system can keep complete accounts of transactions as it is based on dual aspects of each transaction, i.e., debit and credit, are recorded simultaneously.įor this reason, this system maintains accounts of all parties relating to transactions. The advantages of the double-entry system are stated in brief In every organization, whether big or small accounts are kept under the double-entry system. In the modem age, this system is accepted as the best one. The double-entry system is the most scientific method of keeping accounts.

Financial statements: In the fourth or final stage through financial statements, the results of all the financial activities of a year are determined.

Doubl entry bookkeeping examples trial#

Trial balance: In the third phase, the arithmetical accuracy of the account is verified through the preparation of the trial balance. Ledger: In the second phase, transactions are classified and recorded permanently in the ledger in brief. Journal: At first, transactions are recorded in the primary book of accounting called a journal. The process of keeping accounts under the double-entry system As a result, the main objective of accounting will be frustrated. If there is an exception to this, complete information will not be available in the books of accounting. In fine, it can be said that every transaction must possess these characteristics. Through this system, the account is kept completely, and no party is ignored. Complete accounting system: Double entry system is a scientific and complete accounting system. In its ascertainment of the result is easy. Results: Under double entry system totality of debit is equal to the totality of credit. The left side of the transaction debit and the right side is credit. Dual aspects: Every transaction is divided into two aspects. Here the business is considered as a separate entity. Separate entity: Under this system, business is treated as a separate entity from the owner. Exchange of equal amount: The amount of money of a transaction the party gives is equal to the amount the party receives.

Giver and receiver: Every transaction must have one giver and one receiver.According to the main principles of this system, every debit of some amount creates corresponding credit, or every credit creates the corresponding debit for the same amount.

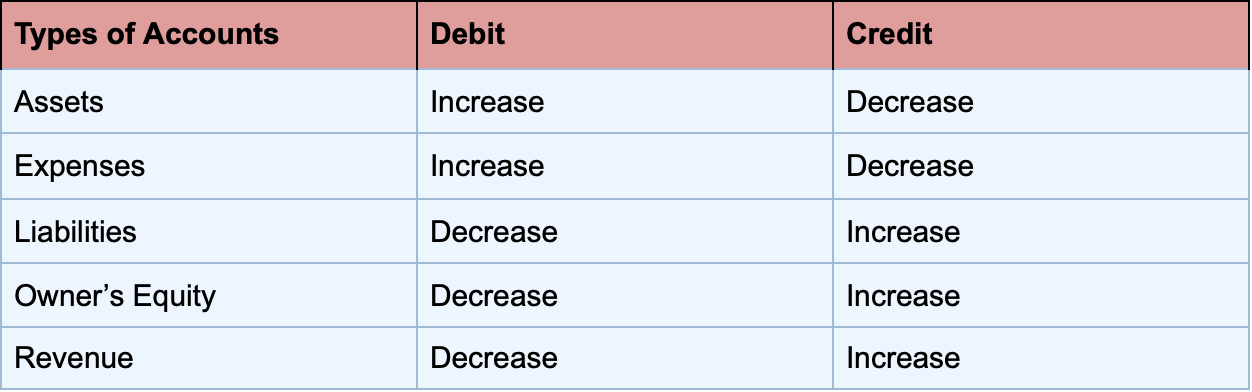

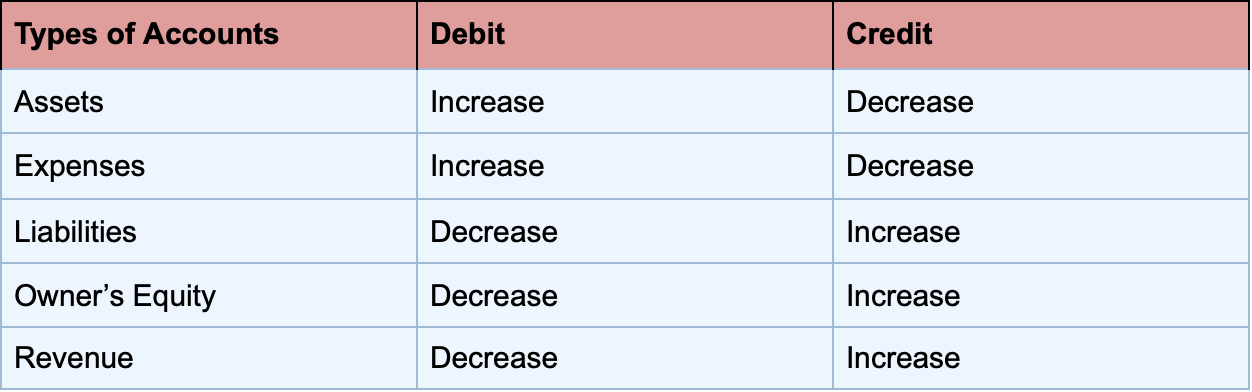

Two parties: Every transaction involves two parties – debit and credit. Following some widely accepted characteristics or principles, the account is kept under this system.Īs a result, on one side, the arithmetical accuracy of the transaction is ensured, and on the other side, ascertainment of the financial position of the business is easily possible.Ĭharacteristics of the double-entry system are stated below The double-entry system is a scientific, self-sufficient, and reliable system of accounting. Characteristics or Fundamental Principles of Double Entry System Double-entry Book-Keeping is a system by which every debit entry is balanced by an equal credit entry. You can easily check whether your bookkeeping is correct, because the balance in your bank account or cash register must match the balance in your bookkeeping after entries are posted.Every debit must have a corresponding credit and Vice – Versa. Clear, easy to follow bookkeeping helps you avoid problems, for example with the tax authorities. You know what proportion of your business is financed by equity or debt. The information gained from double-entry bookkeeping can be used to develop other key performance indicators that help you measure and increase your company's success: for example, cash-flow and liquidity. It provides a large amount of useful additional information: for example, how much money your company has spent on specific things, the value of your stocks, and exactly how much money your company has on any given day. Double-entry bookkeeping, on the other hand, is an important tool for a company's success. Simple bookkeeping (cash-basis accounting) can only show whether an account is running a profit or loss.

Two parties: Every transaction involves two parties – debit and credit. Following some widely accepted characteristics or principles, the account is kept under this system.Īs a result, on one side, the arithmetical accuracy of the transaction is ensured, and on the other side, ascertainment of the financial position of the business is easily possible.Ĭharacteristics of the double-entry system are stated below The double-entry system is a scientific, self-sufficient, and reliable system of accounting. Characteristics or Fundamental Principles of Double Entry System Double-entry Book-Keeping is a system by which every debit entry is balanced by an equal credit entry. You can easily check whether your bookkeeping is correct, because the balance in your bank account or cash register must match the balance in your bookkeeping after entries are posted.Every debit must have a corresponding credit and Vice – Versa. Clear, easy to follow bookkeeping helps you avoid problems, for example with the tax authorities. You know what proportion of your business is financed by equity or debt. The information gained from double-entry bookkeeping can be used to develop other key performance indicators that help you measure and increase your company's success: for example, cash-flow and liquidity. It provides a large amount of useful additional information: for example, how much money your company has spent on specific things, the value of your stocks, and exactly how much money your company has on any given day. Double-entry bookkeeping, on the other hand, is an important tool for a company's success. Simple bookkeeping (cash-basis accounting) can only show whether an account is running a profit or loss.

0 kommentar(er)

0 kommentar(er)